Hospitality Investment Funds: Opportunities in the Portuguese tourism sector

April 15, 2025

Hospitality Investment Funds: Investment opportunities in the Portuguese tourism sector

The hotel sector in Portugal has experienced exponential growth in recent years. According to INE (Statistics Portugal), the number of guests has increased by an average of 2.4% per year over the last four years, reaching 32.5 million in 2023, making it one of the key pillars of the national economy. This positive trend has attracted the attention of both national and international investors, leading to the creation of several hotel investment funds aimed at capitalizing on emerging market opportunities.

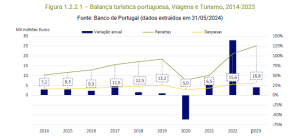

Portuguese tourism balance, Travel and Tourism, 2014 – 2023:

Growth of the hotel sector in Portugal

Portugal stands out in Europe as one of the countries with the highest number of hotel projects under development. According to the Europe Hotel Construction Pipeline Trend Report, over 114 new hotels are expected to open in the country by 2026, totalling around 14,247 rooms. This places Portugal among the top five European countries with the highest number of upcoming hotel openings, just behind the United Kingdom, Germany, France, and Turkey.

This expansion is driven by several factors, including increasing tourism, economic stability, and growing interest from foreign investors. In 2024, the hotel sector accounted for 21% of total commercial real estate investment in Portugal, with transaction volumes surpassing €500 million.

Hotel investment funds: A strategic investment tool

Hotel investment funds are financial instruments that allow investors to participate in the growth of the tourism sector while diversifying their portfolios and enjoying attractive returns. These funds can take various forms, from venture capital funds to specialized real estate funds, and are often used to finance the acquisition, development, or renovation of hotel assets.

In addition, hotel funds provide an opportunity for foreign investors to obtain a Portuguese passport, commonly referred to as the Golden Visa, giving them the possibility of residing in Portugal and, once they have fulfilled the legal requirements, obtaining Portuguese citizenship.

Since 2023, real estate investment funds are no longer eligible for Golden Visa purposes, making hotel investment funds a viable alternative with high return potential.

To obtain a Golden Visa, the investment can be directed to venture capital or private equity funds, for a minimum amount of €500,000.

Investment trends in the sector

Investment in the hotel sector in Portugal has been influenced by several key trends that reflect shifts in consumer preferences and investor strategies:

Diversification of international operators

- There is an increasing presence of international operators, particularly in the luxury segment. This is accompanied by a rise in serviced apartments for extended stays, responding to the demand for more personalized and flexible travel experiences.

Focus on sustainability and ESG

- Investors are paying more attention to environmental, social, and governance (ESG) practices. Projects that align with ESG criteria are attracting significant capital, with investors willing to pay above market value for sustainable assets. Integrating ESG considerations into investment decisions has become a strategic priority, marking a structural shift in the sector.

Foreign investment

- According to Cushman & Wakefield, foreign capital accounted for more than 70% of total hotel investment in 2024, with strong activity from French and Spanish investors. This trend highlights Portugal’s growing appeal as an international investment destination in the hospitality sector.

Future outlook for hotel investment funds

The outlook for hotel investment funds in Portugal is promising, supported by a combination of favorable economic, social, and political factors:

Continued Tourism Growth

- Tourism in Portugal continues to expand, driven by the country’s cultural diversity, natural beauty, and hospitality. This growth sustains the demand for quality accommodation and creates new opportunities for hotel investment funds to invest in development or renovation projects.

Government Support

- The Portuguese government has allocated €30 million to further develop the tourism sector, including significant investment in the modernization of hospitality and tourism schools. This support helps train skilled professionals who are essential to the sector’s excellence.

Innovation and Technology

- The adoption of technology in the hotel sector, from management systems to sustainability solutions, offers new investment opportunities. Funds that embrace innovation can benefit from competitive advantages and superior returns.

TEPPE Equity Venture Capital Fund: A strategically positioned investment solution in the hotel sector

This fund is designed to meet the expectations of global investors seeking returns over a short investment horizon. With a strategy grounded in proven investment practices and a clear focus on large-scale projects, the fund contributes to the dynamism of the Portuguese hotel market. It targets assets located in strategically selected areas of the country, chosen for their high growth potential and strong appreciation prospects.

In summary, hotel investment funds play a crucial role in the development of the tourism sector in Portugal. By providing capital for the acquisition, renovation, and construction of hotel assets, these funds support economic growth, job creation, and the promotion of Portugal as a prime travel destination. With a favourable investment climate, government backing, and rising tourism demand, hotel investment funds are well-positioned for sustainable success.

Similar News

December 12, 2025

Venture Capital Funds: The Most Relevant Strategy for the Golden Visa in 2026

Read more

September 30, 2025

Investment in the Hospitality Sector in Portugal: Opportunities, Trends, and Sector Growth

Read more

August 4, 2025

Portuguese passport is one of the best in the world

Read more