Aspiring luxury travelers prefer to spend on specific experiences, such as helicopter tours or fine dining, while being less selective about other aspects of their trips. They value visible brands and loyalty program benefits and represent a significant and growing segment. Understanding this group is crucial for brands, as these customers may become loyal as their wealth increases.

Investing in the Hospitality Sector in 2024: Opportunities and Trends for Sustainable Growth

August 29, 2024

According to the McKinsey & Company report, and as a result of the strong growth of recent decades, the tourism and hospitality sector is experiencing a period of disruption.

Transformations in origin and destination markets, the growth in demand for luxury travel and experiences and innovative business strategies seem to be combining to profoundly change the landscape of the industry.

New travelers, destinations and trends

Tourism and hospitality companies and investors need to develop strategies to respond to new trends and stay alert to an increasingly disruptive market.

- The destination is increasingly “on your doorstep”: While international travel may grab attention, stakeholders should not overlook the significant opportunities at home. Domestic travel continues to represent the majority of travel spending, and intraregional tourism is on the rise. Generation Z is the most eager to travel.

- Personalization: While individual personalization may not always be feasible, savvy industry professionals can use segmentation and hypothesis-based testing to refine their value propositions. Those who fail to identify target customer segments and tailor their offerings accordingly risk falling behind. Travelers are increasingly seeking personalized experiences.

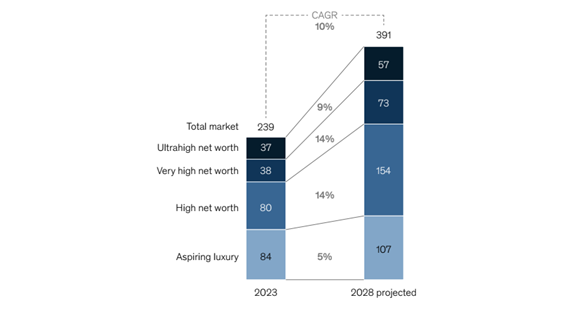

- Growth of the luxury travel sector: The demand for luxury tourism is expected to grow faster than any other travel segment today. It is crucial to understand that luxury travelers do not constitute a homogeneous group. Segmentation by age, nationality, and net worth can reveal diverse and constantly evolving preferences and behaviors.

Increased demand for the luxury market

According to the same study, the demand for luxury tourism and hospitality is growing faster than other segments, driven by the increase in individuals with a net worth between 1 million and 30 million dollars and a growing base of aspiring luxury travelers with a net worth between 100,000 and 1 million dollars.

These travelers, often younger, are willing to spend a significant portion of their wealth on luxury travel. A recent survey of 5,000 luxury travelers, conducted in February and March, reveals new insights into their preferences and expectations, challenging some preconceived notions about the sector.

Key trends

The tourism and hospitality sector has undergone significant transformation over the past decade. In the accommodation segment, asset-light models like franchising and management have proliferated, while home-sharing has also been growing.

Here are some trends shaping the sector and offering potential advantages for investors:

- Accommodation

Major hotel brands have increasingly moved away from direct ownership, opting to expand through franchising and management. On the other hand, luxury hotel chains have resisted this trend, often maintaining direct ownership to control quality standards. In the future, we may see some strategic “tuck-in” acquisitions as brands aim to capture both the luxury market and younger demographics, which are currently very attractive.

- Direct Booking

Another rising trend is direct booking. Historically reliant on online travel agencies, hotels are now trying to reestablish direct contact with customers. The goal is to reduce intermediary fees and gain more insights into their guests. To encourage direct bookings, hotels are employing various strategies, such as offering best-rate guarantees, higher reward rates, and improving mobile applications, among other approaches.

The hospitality sector represents an excellent investment opportunity. Over the last ten years, both listed accommodation and experience providers have shown consistent growth in revenues, in line with global GDP. Accommodation providers, in particular, have managed to increase their profits by five percentage points, while experience providers have maintained an average profit margin of 18%, indicating a robust capacity for adaptation and profitability. With solid profit margins being maintained, the sector continues to offer fertile ground for investments that can generate attractive and sustainable returns in the future.

The TEPPE Equity Venture Capital Fund

The TEPPE Equity Venture Capital Fund presents a unique and highly attractive investment avenue within Portugal’s hospitality industry.

This fund is tailor-made for global investors seeking swift and substantial financial returns. With a strategic approach to amplify investment in Portugal’s hotel sector, the TEPPE Equity Capital Fund skillfully blends time-honored investment methodologies with a dynamic and large-scale vision. The main objective is to channel investments into hotel enterprises situated in prime Portuguese locales, identified for their exceptional and swift growth prospects.

Similar News

September 30, 2025

Investment in the Hospitality Sector in Portugal: Opportunities, Trends, and Sector Growth

Read more

April 15, 2025

Hospitality Investment Funds: Opportunities in the Portuguese tourism sector

Read more

August 29, 2024

Investing in the Hospitality Sector in 2024: Opportunities and Trends for Sustainable Growth

Read more